If you're short on time, here are the main takeaways...

- Compare 26 leading platforms for surveys, social listening, UX, and enterprise insights in 2026

- Discover which tools fit your team’s goals, workflows, and budget

- Avoid silos, duplicated work, and slow decision-making

- Learn what to look for in a tool (and what to avoid)

- See why Stravito is the top choice for global brands that want insight-driven growth

Whether you’re refreshing your stack or choosing your first enterprise insights platform, this guide makes it easier to find the right fit.

Let’s start with why these tools matter more than ever.

Why modern brands need the right customer insight tools

Modern brands run on insights. Without the right customer insight tools, it’s hard to keep up with changing customer behavior, shifting market trends, and rising expectations across the customer journey.

The problem with legacy tools like SharePoint and Excel

Many teams still rely on general-purpose platforms to manage research. But these weren’t designed to collect customer insights, analyze data, or drive customer engagement.

Instead, they bury customer feedback and slow down the decision-making process.

When insights live in email threads or are saved as files, no one can find your business risks:

- Duplicated studies

- Missed customer segments

- Low visibility into how customers interact with your brand

And that means slower decisions and weaker outcomes.

What better insight tools make possible

Today’s customer insights platforms go far beyond document storage.

They help you uncover valuable customer insights by combining behavioral analytics, machine learning, and search designed for real workflows.

With modern tools, your teams can:

- Gain a deeper understanding of user behavior

- Quickly identify trends across regions or segments

- Share key insights with marketing, product, and leadership

- Optimize marketing campaigns with real-time data

- Drive customer engagement based on actual customer needs

When your teams use insight tools that make discovery easy, you improve everything from customer satisfaction to retention.

But adoption still matters more than features

Even the most advanced tools for customer insights won’t help if no one uses them.

Many customer research tools focus on specialists and skip the business user entirely. That’s where things go wrong.

The best platforms are designed to make it easy for users to interact with research in the real world. They:

- Work across functions and devices

- Don’t require weeks of training or a dedicated admin

- Make it easy to gather customer insights and share them instantly

- Fit into your knowledge management framework

If your goal is to activate research, not just store it, adoption is everything.

Next, let’s break down how to evaluate customer insights tools and choose the right one for your business.

How to evaluate customer insights tools in 2026

Choosing the right customer insights platform isn’t just about features; it's also about understanding the needs of your customers. So, your business needs a tool that fits how your teams work, what your business needs, and how your customers behave.

Here’s how to assess which customer insight tools will deliver the most value for your team and your ROI.

What to look for in a strong platform

Whether you’re comparing survey tools, UX research platforms, or enterprise insight hubs, the best solutions make it easy to:

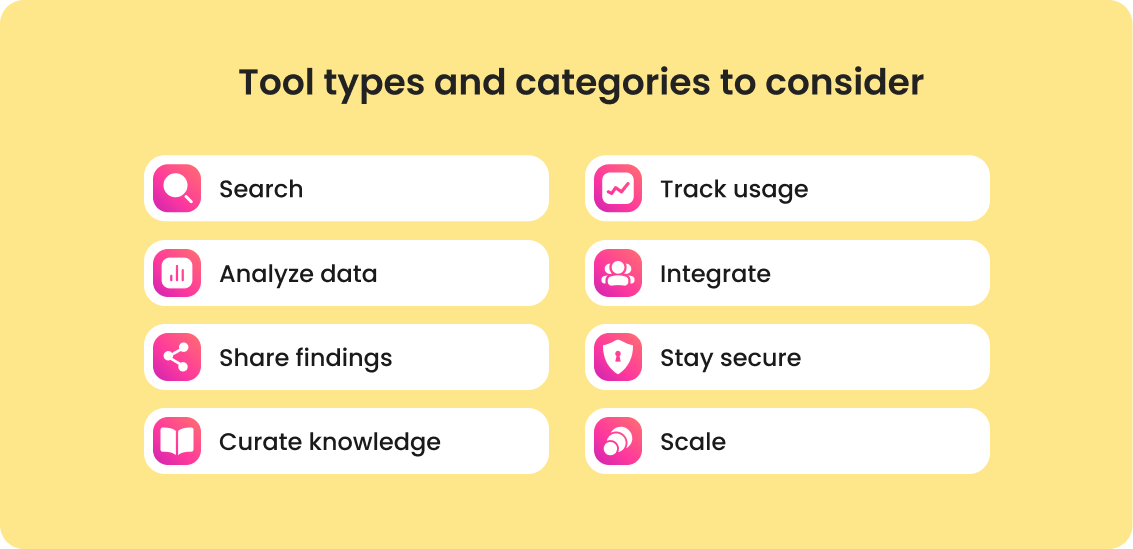

- Search: Find insights fast using natural language search, filters, or tags

- Analyze data: Spot patterns in customer behavior and feedback

- Share findings: Deliver key insights to stakeholders when they need them

- Curate knowledge: Build collections that connect insights across topics

- Track usage: See how teams engage with your customer data

- Integrate: Connect with survey tools, social media platforms, or vendor libraries

- Stay secure: Meet global compliance needs with the right controls in place

- Scale: Grow from pilot to enterprise-wide adoption without friction

Looking for a deeper dive? Explore this knowledge management framework to understand what best-in-class platforms offer.

Common buyer mistakes to avoid

Even experienced teams can get tripped up by these pitfalls:

- Overbuying: Buying complex tools with “advanced survey capabilities” that teams don’t actually use

- Skipping adoption planning: Underestimating the onboarding effort, especially across regions

- Ignoring long-term fit: Choosing software that doesn’t evolve with your growth and enterprise plans

And perhaps most importantly, not thinking enough about usability. If your tool isn’t easy to navigate, your teams won’t gather customer insights consistently, no matter how powerful it claims to be.

Tool types and categories to consider

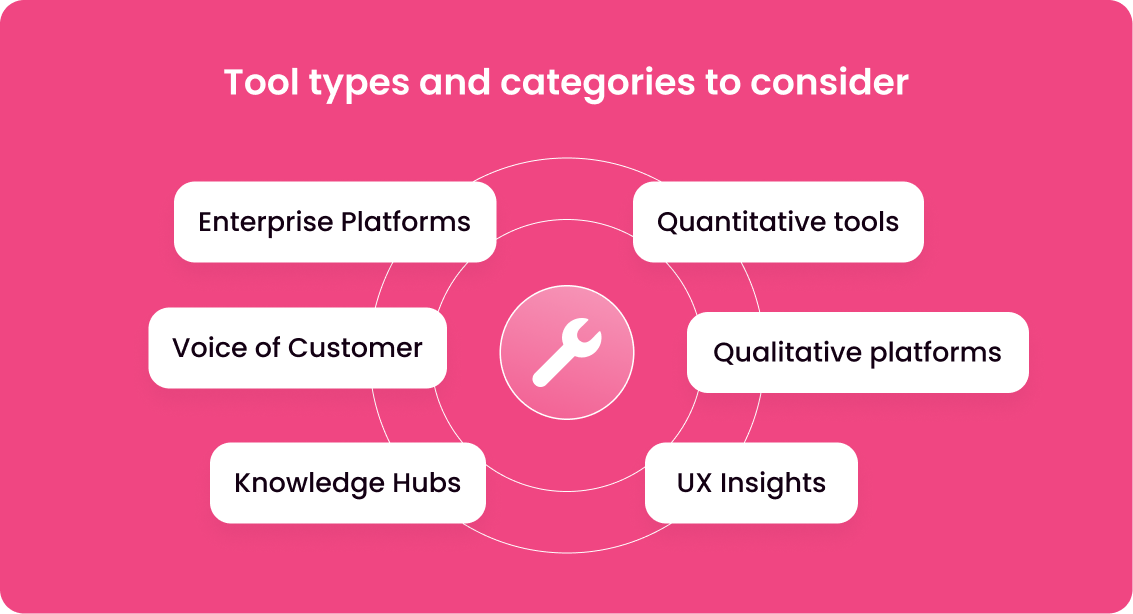

Customer insight tools come in many forms. As you compare options, think about what kind of data you collect and how you want to use it:

- Enterprise platforms: End-to-end insights hubs like Stravito designed for sharing, discovery, and activation

- Quantitative tools: For structured surveys and customer feedback analysis

- Qualitative platforms: For interviews, panels, and analyzing customer conversations

- UX and user insights tools: To understand how users interact with your site or product

- Voice of customer and social media tools: To monitor customer sentiment and track brand perception

- Knowledge hubs and integrations: To organize collected customer data from across systems

You can also explore this guide to UX research repository tools to see what options work best for research-heavy teams.

Next, we’ll walk through 26 top customer insight tools to help you find the right match for your use case.

The 26 Best Customer Insight Tools in 2026

There’s no one-size-fits-all platform for insights. Some tools are built for large global teams managing complex workflows. Others help you gather customer feedback at speed or uncover patterns in user behavior.

We’ve grouped these 26 customer insight tools into six categories, allowing you to explore what fits best based on your needs, budget, and goals.

Let’s start with enterprise platforms built for sharing, activating, and scaling insights across organizations.

Enterprise insights & activation platforms

These tools help large companies centralize research and make insights accessible across teams.

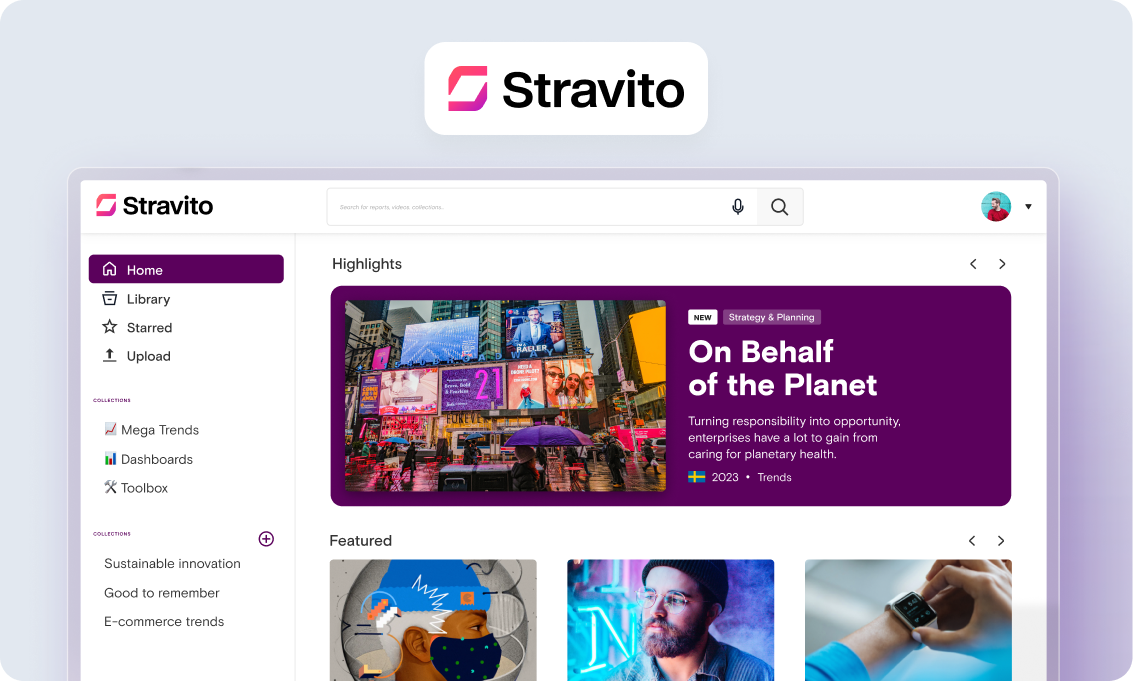

1. Stravito

Stravito is an AI-powered consumer insights platform designed for global brands that want to centralize research and turn it into action without heavy onboarding or IT support.

It’s the only platform in this list built specifically for insights and UX teams, combining advanced tools with unmatched usability.

Best for: Enterprise insights activation across regions and business units

Key features:

- AI-powered search and summarization

- Curated collections and smart tagging

- Usage analytics and weekly stakeholder digests

- Prebuilt integrations with research vendors (e.g., Mintel, Kantar)

- Instant deployment with no IT project

Limitations:

Not a survey or panel tool. It complements, not replaces, your research stack

Standout differentiator:

Stravito isn’t just for storing research. It’s built to help global teams uncover valuable customer insights, share them across functions, and track what gets used.

Brands like Heineken, Electrolux, Coles, and Delta use Stravito to scale insight usage, reduce duplicated work, and move faster on strategic decisions.

Request a Stravito demo to see it in action.

2. Qualtrics

Qualtrics is a robust experience management platform that helps brands track, understand, and improve customer interactions across touchpoints.

- Best for: Voice of customer (VoC), surveys, and experience analytics

- Key features: Survey logic, dashboards, workflow automation, integrations with Salesforce, and more

- Limitations: Can be complex to set up and expensive to scale without internal support

- Standout differentiator: Deep analytics across customer journey stages, backed by powerful AI and advanced tools

3. Medallia

Medallia specializes in omnichannel VoC and behavioral analytics, helping enterprises improve customer experience at scale.

- Best for: Experience tracking across touchpoints and real-time customer sentiment

- Key features: Text analytics, video feedback, mobile capture, predictive insights

- Limitations: Some users report a steep learning curve for customization

- Standout differentiator: Real-time alerts and machine learning-based recommendations for frontline teams

4. Forsta

Forsta (formerly Confirmit + FocusVision) offers an end-to-end consumer intelligence platform with both quantitative and qualitative capabilities.

Best for: Research agencies and brands looking for flexible dashboards and data visualization

- Key features: Survey tools, quality video capture, advanced reporting, and CX analytics

- Limitations: Can feel bloated for smaller teams focused on just one research method

- Standout differentiator: Combines survey data with qualitative inputs in one place

5. Kantar Marketplace

Kantar Marketplace is a research-on-demand platform offering both syndicated and custom studies for brand, creative, and innovation testing.

- Best for: On-demand studies to support marketing campaigns and product development

- Key features: Fast turnaround, validated methodologies, flexible pricing

- Limitations: Not a full customer insights platform. Best used alongside other tools

- Standout differentiator: Combines self-service speed with the credibility of Kantar’s global research network

Next up: Quantitative, survey & analytics tools - perfect if your teams need to gain customer insights and analyze structured data quickly.

Quantitative, survey & analytics tools

These tools are ideal for teams focused on testing hypotheses, validating product ideas, or evaluating campaign impact.

6. SurveyMonkey

SurveyMonkey is a popular survey platform for quickly collecting and analyzing customer feedback, whether you’re working on small projects or running enterprise research.

- Best for: Quick surveys and pulse checks across customer segments

- Key features: Drag-and-drop builder, templates, basic analytics, export options

- Limitations: Limited logic and customization in lower-tier plans

- Standout differentiator: Easy-to-use interface and broad brand recognition for fast rollout

7. Google Analytics / GA4

Google Analytics (now GA4) is still one of the most widely used customer research tools for understanding how users interact with websites and digital products.

- Best for: Website traffic, funnel analysis, and user behavior metrics

- Key features: Real-time tracking, event-based data model, built-in reports

- Limitations: Steep learning curve; not built for qualitative insights or customer feedback

- Standout differentiator: Free to use and integrates easily with other Google tools like Google Ads and Google Trends

8. Alchemer

Alchemer (formerly SurveyGizmo) gives businesses more flexibility than basic survey tools, especially if you need to tailor analytics and logic paths.

- Best for: Advanced survey capabilities and enterprise-grade data collection

- Key features: Custom workflows, embedded surveys, multilingual support

- Limitations: Less intuitive than other tools; can feel overly technical for casual users

- Standout differentiator: Highly customizable surveys and real-time analytics for complex customer feedback scenarios

Next up: Qualitative & UX research tools, ideal if you’re looking to explore how users interact with products, test new ideas, and uncover detailed insights from customer conversations.

Qualitative & UX research tools

These tools are particularly useful for UX teams, product managers, and researchers who work with both qualitative and quantitative data.

9. UserTesting

UserTesting helps companies gather fast, video-based feedback from real users. It’s built for teams that need to test prototypes, content, and experiences with their target audience.

- Best for: Video feedback and remote usability testing

- Key features: Screen recordings, task tracking, highlight reels, panel recruitment

- Limitations: Can get costly at scale; less suited for deep qualitative synthesis

- Standout differentiator: Real-time reactions from users help you analyze user behavior in context

10. Hotjar

Hotjar is a behavioral analytics tool that enables you to easily track how users interact with your site. It combines heatmaps, session recordings, and surveys to give you insight into user interactions.

- Best for: UX behavior tracking for websites and landing pages

- Key features: Click maps, scroll tracking, conversion funnels, feedback polls

- Limitations: Focused on web UX and less coverage for product or mobile app testing

- Standout differentiator: Fast setup and clear visualizations of how users interact with your content

11. Maze

Maze is a remote user testing tool that blends quant and qual feedback to help teams make data-driven product decisions.

- Best for: Product teams validating ideas and flows early

- Key features: Prototype tests, card sorting, tree testing, usability scoring

- Limitations: Best with tools like Figma; not a full insights repository

- Standout differentiator: Offers fast, unmoderated testing with quant-backed reports

12. UXTweak

UXTweak is a cost-effective platform that helps teams gather user feedback and test usability across web and mobile products.

- Best for: Small UX teams or startups looking for affordable testing tools

- Key features: Session recordings, surveys, preference tests, A/B comparisons

- Limitations: Limited third-party integrations compared to larger platforms

- Standout differentiator: Lower price point with solid coverage of core UX research methods

13. Lookback.io

Lookback.io supports live, moderated UX interviews with screen sharing and session recording, enabling you to capture rich, qualitative feedback.

- Best for: One-on-one UX interviews and real-time observation

- Key features: In-browser live sessions, time-stamped notes, team collaboration

- Limitations: Less suited for scaling or organizing ongoing studies

- Standout differentiator: Makes it easy to run moderated sessions without external tools

14. Delve

Delve is a qualitative coding and analysis tool that helps researchers tag and organize insights from interviews and open-ended responses.

- Best for: Academic-style qual analysis or atomic research

- Key features: Codebooks, auto-tagging, team annotations, data visualizations

- Limitations: Less emphasis on sharing or cross-team visibility

- Standout differentiator: Deep analysis workflows for qualitative researchers

15. Great Question

Great Question is an all-in-one research ops tool that supports recruiting, scheduling, and organizing research findings.

- Best for: Teams looking to streamline participant management and insight tracking

- Key features: Recruit management, templated surveys, research repository

- Limitations: May require integrations to handle complex analysis or reporting

- Standout differentiator: Research ops + repository in one platform

16. Aurelius

Aurelius helps researchers synthesize findings into actionable insights using tagging and themes.

- Best for: Qualitative data synthesis and insight tagging

- Key features: Themes, tagging, key insights exports, participant tracking

- Limitations: Not ideal for large cross-functional sharing or automation

- Standout differentiator: Focused on making it easy to go from raw feedback to usable insights

17. Dovetail

Dovetail is a popular user insights tool for analyzing interviews, creating highlight reels, and building a searchable research archive.

- Best for: Centralizing and analyzing qualitative research

- Key features: Video transcription, tagging, visualizations, clip creation

- Limitations: Primarily built for researchers and not ideal for broad stakeholder use

- Standout differentiator: Researcher-first design with powerful text analysis and tagging tools

18. Condens

Condens is a lightweight UX research repository tool that helps teams store, organize, and share qualitative research findings.

- Best for: Small teams building an insights archive

- Key features: File uploads, tagging, custom views, highlight sharing

- Limitations: Basic analytics; less automation than some competitors

- Standout differentiator: Clean UX and low lift for teams just starting to centralize insights

Next, we’ll explore social listening, voice of customer, and consumer intelligence platforms.

Social listening, voice of customer, and consumer intelligence platforms

These tools help you tap into what customers are saying in reviews, social media posts, contact centers, and more. If you’re looking to analyze social media performance, measure customer sentiment, or identify trends across channels, this cluster delivers real-time visibility and consumer insights.

19. Sprinklr

Sprinklr is an enterprise-grade platform for unified customer experience management across more than 30 digital channels.

- Best for: Large brands monitoring customer conversations at scale

- Key features: Social listening, influencer tracking, reporting dashboards, case routing

- Limitations: Can feel overwhelming; long setup time for full deployment

- Standout differentiator: Combines voice of customer data with marketing and care insights in one platform

20. Brandwatch

Brandwatch offers deep consumer intelligence through real-time analysis of online conversations and social media platforms.

- Best for: Social media trend analysis and brand health tracking

- Key features: Custom dashboards, sentiment analysis, visual listening

- Limitations: High cost for full feature access

- Standout differentiator: AI-powered trend detection and historical data access across millions of sources

21. Meltwater

Meltwater combines media monitoring with customer research, giving brands visibility across news, social, and broadcast channels.

- Best for: PR teams and brand managers needing real-time alerts and sentiment insights

- Key features: News tracking, social listening, influencer discovery, analytics

- Limitations: Interface can feel dated; limited customization for non-PR use cases

- Standout differentiator: Broad coverage of traditional media + social for a complete external view

22. Gong

Gong provides AI-powered analysis of sales calls and customer interactions, helping B2B companies extract insights from every conversation.

- Best for: Sales teams looking to improve messaging and customer engagement

- Key features: Call recording, conversation intelligence, deal tracking

- Limitations: Built for sales use cases, not traditional customer insights

- Standout differentiator: Pinpoints what top reps do differently using real-world interaction data

Knowledge hubs, data repositories & integrations

These tools are often used to create a knowledge base or house customer data across teams. While flexible, they’re not specifically designed for insights work, which means you may need additional time, training, or IT support to make them suitable for research use cases.

23. Notion

Notion is a highly customizable workspace for note-taking, wikis, and team collaboration. Many insights teams use it to gather and share customer research, though it’s not built for that purpose.

- Best for: Lightweight internal documentation and flexible team wikis

- Key features: Pages, tables, custom templates, embeds, permissions

- Limitations: No semantic search, insight tagging, or native support for research workflows

- Standout differentiator: Strong customization for teams who need structure but want control

24. Airtable

Airtable combines spreadsheet-style views with lightweight database functionality, often used to organize collected customer data or survey results.

- Best for: Project tracking or light CRM-style records

- Key features: Grid views, filters, forms, automations

- Limitations: Can require heavy manual input; lacks research-specific features

- Standout differentiator: Combines structure with flexibility, great for hybrid teams managing workflows

25. Confluence

Confluence is Atlassian’s team collaboration and documentation tool.

- Best for: Technical teams documenting workflows, knowledge, or meeting notes

- Key features: Pages, file attachments, team comments, permissions

- Limitations: Not designed for insights sharing or surfacing key findings

- Standout differentiator: Integrates well with Jira and dev teams’ tool stacks

26. SharePoint

SharePoint is widely used in enterprises as a general-purpose document library, often powering internal intranets or project folders.

- Best for: File storage and team-wide document access

- Key features: Permissions, folders, version control, Microsoft 365 integrations

- Limitations: Not purpose-built for insights; creates silos, slows down discovery

- Standout differentiator: Common default option, but often a knowledge management framework upgrade is needed

With all 26 tools covered, you now have a clear view of what’s out there and what to consider next.

Up next: What to look for in a customer insights platform so you can cut through the noise and find the right long-term fit.

What to look for in a customer insights platform in 2026

Not all tools are built to support how insights teams work. To avoid shelfware, focus on these three must-haves.

Easy to use from day one

If a platform isn’t intuitive, your teams won’t use it.

Look for tools that are simple to navigate, require little training, and support how your teams already work. Fast onboarding is critical, especially in global or high-turnover teams.

Built for activation, not just storage

Storing research isn’t enough. The best customer insights tools make it easy to share curated findings, track usage and surface relevant insights automatically. This helps your teams gain customer insights and act on them faster.

Enterprise-ready features

Make sure the platform supports:

- Data privacy and compliance (GDPR, CCPA)

- Role-based access and permission controls

- Integrations with survey tools and social media platforms)

- Usage analytics to track engagement and ROI

For many global teams, Stravito checks all these boxes without needing a long IT project.

How Stravito helps brands make research actionable in 2026

Stravito is a vertical, AI-powered customer insights platform built for global research, UX, and strategy teams.

Unlike horizontal tools or internal drives, it’s designed to make insights easy to find, share, and use without extra overhead.

Here’s how Stravito helps teams turn research into results.

Out-of-the-box setup with no IT lift

Stravito is easy to roll out across the business. Most customers are up and running within days, with minimal complex setup and no lengthy training required.

It seamlessly integrates into your knowledge management framework and starts delivering value quickly.

AI-powered discovery and curated collections

Stravito’s Assistant helps teams gain customer insights faster. It can summarize documents, surface related content, and suggest next steps, so insights don’t get lost in PDFs.

Search works the way your teams think. Whether someone types “sparkling water trends” or “soda insights,” they’ll get smart results based on meaning, not just keywords.

Designed for ongoing engagement

Stravito makes insights stick with:

- Curated scrapbooks for teams and topics

- Weekly digests to surface new and relevant research

- Usage analytics to track which insights get used, and by whom

It’s about driving internal customer engagement, so teams don’t just store knowledge; they apply it.

Real-world results from global brands

- Heineken uses Stravito to scale insights globally and stay ahead of consumer trends.

- Coles improved research accessibility across teams, accelerating time to insight.

- Electrolux reduced duplicated work and made it easier for stakeholders to find actionable insights.

- Delta gained visibility into insight usage and strengthened cross-functional collaboration.

Ready to see your research work harder?

If your teams are tired of silos, duplicated work, or insights that get ignored, it’s time for a smarter platform. Request a Stravito demo and discover how easy insight activation can be.

Time to put your research to work

Customer insight tools should do more than store research. The right platform helps your teams find answers fast, share what matters, and turn insights into action.

If you’re ready to work smarter and move faster, Stravito makes it easy to activate insights at scale. No IT project needed.

Customer insight tools FAQs

1. What is a customer insight tool?

A customer insight tool helps you collect, organize, and share research about your customers, so teams can make better decisions based on real data and behavior.

2. How do customer insights platforms drive brand growth?

They reduce duplicated work, improve speed to insight, and help teams align around what customers need, boosting performance across marketing, product, and strategy.

3. Which customer insights software is best for global teams?

Look for platforms that support multilingual search, enterprise security, and easy sharing across teams and time zones. Stravito is purpose-built for global insights teams.

4. How is Stravito different from Dovetail, Medallia, or Qualtrics?

Stravito focuses on insight activation, not just storage or survey deployment. It’s built for usability, fast setup, and sharing research across your business, not just within research teams.

5. Can I use multiple customer insight tools together?

Yes. Many teams use a mix, like surveys for feedback and a platform like Stravito to centralize and activate those insights.