This article first appeared as a part of the Big Ideas series on the GreenBook blog. It has been reposted with permission.

Change is the only constant. Even the ancient Greeks understood that. Yet changing established practice and culture in multinational organisations is becoming harder than ever. Some consumer packaged goods companies (CPGs) have found successful strategies to gain market share, shift their culture to be more data-driven and be more like the new digitally native entrants threatening their extinction.

An existential crisis

Leading CPGs are faced with fiercer competition from all sides. Direct-to-consumer startups like Soylent, Warby Parker, Casper and Glossier are disrupting distribution models with strong backing from venture capital firms. Online retail giants like Amazon and Alibaba are becoming so big that their actions in themselves significantly impact CPG sales. Former CPG partners, in the form of big retailers, are launching their own white label brands pushing out traditional CPG brands from the physical shelf-space.

The new normal

There are two underlying factors enabling these changes. The first is these new companies’ ability to collect and harness customer data and insights. Online distributors know what people look at, how long they spend doing so, what their reviews are and also what people looked at but ended up not buying. The second factor is the new entrants being agile enough to deploy those insights into the business; to launch new products, channels or even entire businesses. Amazon’s launch of their own furniture brands Rivet and Stone & Beam is a prime example of the company putting learnings from stocking competing products on their site into a new venture.

It’s true that this is easier for digital native companies. It’s inherent in their processes and platforms to collect data, while agile technical development methods steer the business roadmap and rub off internally on other parts of the organisation. For the traditional CPG however, there are other approaches available to adapt to this modern way of working.

Handshakes or hand-holding

Several global CPGs, with established models and cultures, have recently found two strategies to successfully adopt a more agile and data-driven approach: Acquisitions and Partnerships.

Two high profile examples include Unilever’s acquisition of Dollar Shave Club and Walmart’s acquisition of Jet.com. Both took back lost market share, introduced new digital distribution and provided a wealth of customer data – in addition to injecting a pool of new thinkers into the existing organisations.

The other increasingly common approach is partnerships with technology startups. A recent example is food waste startup Karma’s collaboration with electronics giant Electrolux to introduce a smart fridge for grocery stores, while Unilever’s Foundry connects dozens of startups with its many brands to accelerate business innovation.

These two strategies help companies to learn new applications for their data – to leverage the insights and knowledge that they have from the past and apply them in today’s new setting, to understand digital business models for distribution and to establish new and more agile ways of working.

A brighter future

It’s been said that the world’s most valuable good is no longer oil, but data. And most traditional CPGs have decades of it. Now they need to rise to the challenge and introduce new methods for leveraging it to apply their existing knowledge in today’s business environment. To understand and adapt to digital transformation. To develop new and more agile ways of working to find new competitive advantages. To take them into a brighter future.

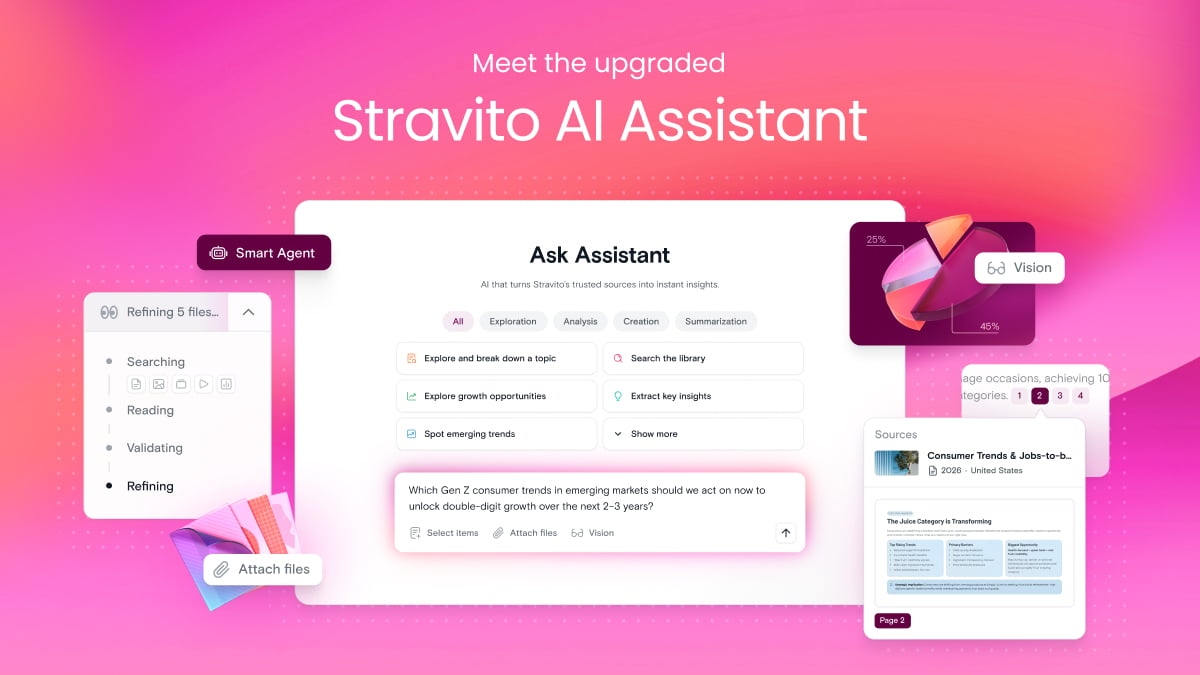

During our talk at IIeX Europe 2019 on February 18, you will hear about how Danone opted to partner with our startup to adopt AI and harness existing insights and data to empower the company’s strategies for years to come. We hope to see you there.

In this blog

Author