TL;DR: Your 30-second summary of what you’ll learn

- What competitive intelligence is and why it matters in business today.

- The main types of competitive intelligence and when to use each.

- The competitive intelligence process from gathering to activation.

- Techniques, tools, and platforms for reliable CI data and analysis.

- How to turn competitive insights into strategies that give you an edge.

Product launch. Price cut. New entrant. Competitive intelligence helps you see it early and choose the right response.

In fast-moving markets, the teams that catch these signals first shape the outcome.

We know that missing one shift can mean lost revenue, lower market share, or weaker customer trust.

You are not alone.

For competitive intelligence professionals and strategy leaders like you, staying ahead in today’s competitive landscape means spotting both threats and opportunities early enough to gain a real competitive edge.

We’ve put together this guide to give you proven techniques, tools, and frameworks that turn competitive intelligence data into strategic moves your teams can act on right away.

Let's start by defining what competitive intelligence is.

Defining competitive intelligence

What is competitive intelligence?

Competitive intelligence is the discipline of transforming market signals, competitor moves, and customer insights into strategic intelligence that guides high-stakes business decisions.

But if you’re leading CI today, you know the definition isn’t the hard part.

The real challenge is separating signal from noise, aligning efforts to the business strategy, and activating insights fast enough to protect market share and create an edge.

In 2025, the role has shifted again. Markets move faster, competitors change plans weekly, and data pours in from everywhere. Winning teams don’t just gather more information. They analyze and activate it quickly so leadership can act in time.

Why tracking competitors is only part of the picture

Tracking competitor strategies is important, but it is only one part of competitive intelligence research.

Modern CI also covers market trends, emerging technologies, regulatory changes, and shifting customer needs.

This broader approach to competition intelligence ensures your teams are prepared for changes that extend beyond direct competitors.

This wider view of competition intelligence helps your teams track the shifts that matter most.

These signals matter because they can:

- Reveal new opportunities, such as spotting a fast-growing customer segment or emerging market before others do

- Warn of upcoming threats, such as identifying a disruptive technology that could replace your product

- Highlight compliance risks like tracking regulatory changes that could impact how you sell or operate

- Guide long-term strategy by seeing shifts in consumer behavior that call for a product pivot

This wider view helps you understand the forces shaping your industry, not just the moves of individual competitors.

CI as your early warning system

Competitive intelligence works like an early warning system, giving you time to prepare before changes hit your business.

It can flag a competitor’s pricing shift before it pulls customers away, or spot an emerging technology that could reshape your market.

Ignore these signals and you risk being caught off guard, reacting in weeks to moves your competitors planned for months.

Acting early means you can adjust your strategy, protect revenue, and stay ahead.

How CI connects research, strategy, and operations

Competitive intelligence combines internal insights with external market intelligence to guide business decisions.

Key inputs include:

- Sales data such as win/loss insights, customer objections, and competitor mentions

- Marketing results such as campaign performance, audience engagement trends

- Product feedback, such as feature requests, usability issues, and adoption rates

- Operational data such as supply chain updates, cost shifts, and resource planning

When shared across teams, this intelligence helps:

- Shape product roadmaps around real customer needs

- Focus marketing on the most promising opportunities

- Prepare operations for changes in demand or market conditions

- Keep strategy aligned with market reality

When your research, strategy, and operations work from the same intelligence, your business can move faster and with more confidence.

Next, let’s look at the main types of competitive intelligence you can use to cover every angle of your market.

Why competitive intelligence is a business essential - not just a “nice to have”

The best strategies are built on facts, not guesses.

The companies that treat CI as core to strategy use it to track industry trends, spot emerging trends, and secure a competitive advantage before rivals can react.

In short, competitive market intelligence gives your business the insight to make the right call before it’s too late.

The cost of flying blind

When decisions are made without competitive intelligence research, the risks are real:

- Market shocks that catch teams unprepared

- Missed competitive threats that erode market share

- Slower innovation as teams react instead of lead

Without this visibility, leadership risks missing actionable insights that could shape pricing, positioning, and product direction.

CI informs real business decisions

From product launches to mergers and acquisitions, business competitive intelligence shapes moves that impact the entire organization.

It can:

- Validate product-market fit before launch

- Identify pricing opportunities or risks

- Flag potential acquisition targets or threats

- Support market entry and expansion strategies

Case in point: Avoiding a costly product failure

A global CPG brand planned to launch a new product in a high-growth category.

Competitive intelligence revealed that a rival had secured exclusive retail partnerships and was flooding the market with marketing ahead of the launch date.

The brand adjusted its strategy, shifted distribution, and avoided a head-to-head clash that could have cost millions.

The difference between managing CI and winning with CI

Not every competitive intelligence effort delivers the same impact. Some companies focus on managing CI, while others use it to create real strategic advantage.

Companies that manage CI:

- Collect data, but store it in a disconnected competitive intelligence database

- Share reports only with a small group of stakeholders

- React to competitor moves after they happen

Companies that win with CI:

- Centralize intelligence in an accessible platform

- Deliver insights to every team that can act on them

- Use CI to shape proactive, long-term strategy

Knowing why competitive intelligence matters is only half the story. Next, let’s look at what it covers and the areas every CI program should track.

What competitive intelligence covers

Competitive intelligence covers everything from competitor analysis and market insights to technology trends and regulatory changes.

CI works best when it covers the full picture, not just competitor moves. This means tracking a mix of strategic and tactical intelligence to guide both long-term planning and day-to-day decisions.

Market intelligence

Keeps your business aware of market trends, emerging technologies, and economic shifts that could open opportunities or create risks.

Examples:

- Identifying high-growth market segments

- Tracking emerging market opportunities in new regions

- Watching for regulatory changes that affect your industry

Product intelligence

Focuses on competitor products and services, including features, pricing strategies, and go-to-market approaches.

Examples:

- Comparing product roadmaps and release cycles

- Spotting gaps in competitor offerings

- Tracking competitor pricing changes over time

Customer intelligence

Gathers customer insights from reviews, surveys, and feedback to understand preferences, pain points, and buying triggers.

Examples:

- Analyzing customer data to identify churn risks

- Tracking shifts in customer sentiment

- Using feedback to refine positioning and messaging

Partner and supplier intelligence

Monitors the relationships and networks that competitors use to gain an advantage.

Examples:

- Identifying potential partnerships for growth

- Tracking supplier changes that could disrupt production

- Mapping competitor alliances in your market

Regulatory and compliance intelligence

Keeps you ahead of legal and compliance changes that may affect your operations.

Examples:

- Preparing for new industry standards

- Understanding compliance requirements in new markets

- Tracking government policy changes that affect market factors

Technology and talent intelligence

Follows advancements in technology and shifts in human resources that could impact competitive positioning.

Examples:

- Monitoring patents and emerging technologies

- Identifying talent gaps in your own business

- Tracking competitor hiring trends to predict strategic moves

Tactical CI often draws on competitor websites, social channels, and field reports to uncover short-term competitor strategies.

Strategic CI uses broader market environment data and competitive benchmarking.

Together, they keep your view of the market balanced.

Once you know what to track, the next step is building a competitive intelligence process that turns this information into actionable insights.

How the competitive intelligence process works

A clear competitive intelligence process ensures you turn information into insights your teams can act on.

Here’s a simple five-step approach used by competitive intelligence professionals in leading organizations:

1. Set clear objectives

Start with business questions, not “monitor everything.” Decide what you need from your competitive intelligence strategy.

Competitive intelligence professionals begin by identifying the strategic insights leadership needs to inform the products and services roadmap.

What you could ask:

- Are you tracking competitor pricing strategies?

- Do you need to spot emerging technologies?

- Are you monitoring market trends for expansion?

2. Identify and prioritize competitors

Look beyond the obvious. Include direct, indirect, and emerging players. Use market mapping and input from sales, marketing, and product teams.

3. Gather competitive intelligence

Collect information from a range of internal and external sources, such as:

- Competitor websites and press releases

- Industry reports and market research

- Customer insights from your sales team

- Social media, reviews, and online forums

- Trade shows and analyst briefings

Alongside primary research, pull from sales data, analyst reports, and competitor websites to understand how to gain market share in your category.

4. Analyze and share insights

Turn competitive intelligence data into insights your teams can use right away.

This could mean spotting trends in the market, identifying gaps through competitive benchmarking, or mapping strengths and weaknesses with a SWOT analysis.

Many teams now use online competitive intelligence platforms to collect and compare real-time market data from digital sources.

Store those insights in a competitive intelligence database so they’re easy to find.

Need practical tips on structuring and organizing this information? See our guide on how to create a knowledge base that teams will actually use.

Then deliver them in the formats your teams prefer - from real-time dashboards and alerts to short executive digests.

Use the data analysis to turn raw inputs into actionable insights that teams can use immediately.

5. Act and measure impact

Use your competitive business intelligence to guide strategy, inform strategic decisions, and protect your market share.

Then, track which insights led to wins, and refine your competitive intelligence process based on results.

With the process in place, let’s explore the techniques and tools that make competitive intelligence more effective and easier to manage at scale.

Key competitive intelligence techniques and tools

Strong competitive intelligence combines proven techniques with the right technology to make them faster and more reliable.

Here are methods your teams can put into practice now:

Competitive benchmarking

Compare your products, services, and performance against key competitors to identify gaps or advantages.

Example: Track competitor pricing strategies quarterly to adjust your own positioning before market share is lost.

Trend analysis

Spot market trends and emerging technologies early so you can act before competitors do.

Example: Use social listening to see which features customers are asking for in your industry, then build them into your roadmap.

SWOT analysis

Assess strengths, weaknesses, opportunities, and threats based on competitive intelligence data.

Example: Map how a competitor’s recent partnership strengthens their distribution network — and what that means for your go-to-market strategy.

Win/loss analysis

Understand why deals are won or lost, and how competitor strategies influence outcomes.

Example: Review sales team notes alongside competitor moves to spot patterns you can address in future pitches.

Tools to power your CI efforts in 2026

The right platform helps you gather competitive intelligence from multiple sources, centralize it in a competitive intelligence database, and share it across teams.

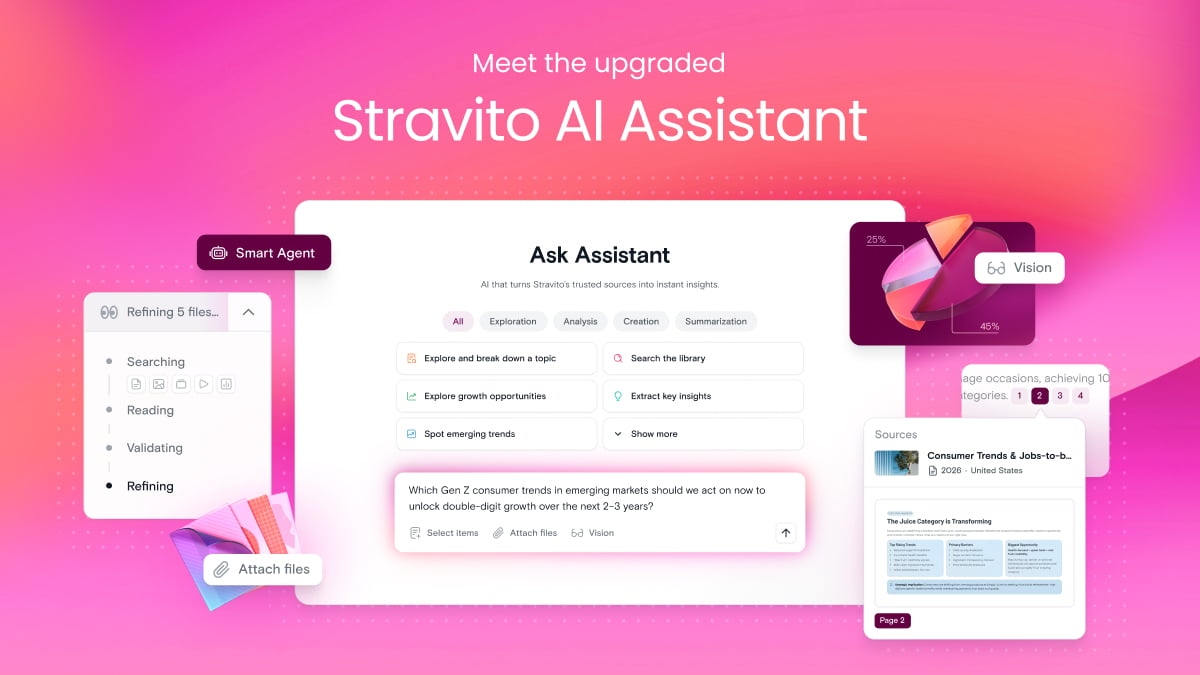

Example: Stravito automatically tags, organizes, and makes your competitive intelligence data searchable so it’s easy to activate.

For a full comparison, see our guide to the best competitive intelligence tools.

Even the best techniques can fail if they’re not used consistently. Next, let’s look at the common pitfalls and myths that keep competitive intelligence from delivering its full value.

4 Common pitfalls and myths in competitive intelligence in 2026

Even experienced teams can fall into traps that limit the value of their competitive intelligence efforts. Avoid these to keep your CI program delivering results.

- Focusing only on direct competitors

It’s easy to track just the “usual suspects,” but indirect and emerging competitors often create the biggest disruptions.

A healthy competitive intelligence business program also incorporates market research to understand emerging market opportunities.

Our pro tip: Include substitute products, new market entrants, and startups in your competitive intelligence monitoring.

- Drowning in data without synthesis

Collecting more information isn’t the goal - making sense of it is.

Without clear goals, even the most advanced business competitive intelligence tools can fail to deliver marketing strategies that protect or grow market share.

Our pro tip: Use frameworks like SWOT or trend mapping to turn data into actionable insights your teams can use.

- Treating CI as a side project

Competitive intelligence works best when it’s part of the overall business strategy, not something done in isolation.

Our pro tip: Embed CI updates into strategic planning, product development, and sales enablement routines.

- Overlooking ethical boundaries

Competitive intelligence and analysis must follow legal and ethical guidelines.

Our pro tip: Stick to public and legally obtained sources, and set governance rules for your CI activities.

To avoid these pitfalls, CI has to be part of your company’s DNA.

Now, let's explore how to build a competitive intelligence culture that lasts.

Building a competitive intelligence culture

Competitive intelligence delivers the most value when it becomes part of how your business operates, not just a specialist team’s job.

For competitive intelligence professionals, this shift is what turns CI from a side project into a driver of business competitive intelligence.

Make CI everyone’s responsibility

Insights can come from any department, including sales, marketing, product, or customer support. Involving multiple teams also improves your view of the broader competitive landscape.

Your next step: Encourage teams to share observations from customer conversations, competitor interactions, and market events.

Integrate CI into daily workflows

The best CI programs are woven into existing processes, from product planning to quarterly business reviews.

This ensures your competitive intelligence strategy is tied to core business goals and can adapt to emerging market opportunities.

Your next step: Set up a regular cadence for competitive intelligence updates and align them with your strategic decision cycles.

Incentivize sharing and collaboration

Reward teams that contribute valuable competitive intelligence data and actionable insights.

These contributions help refine marketing strategies, protect market share, and uncover competitor strategies you might otherwise miss.

Your next step: Highlight contributions in company meetings or internal newsletters to build visibility and motivation.

Use technology to break silos

A centralized competitive intelligence database ensures that once information is captured, it is accessible to everyone who needs it.

If you are building your CI program from the ground up, a strong knowledge management framework can help align your structure with business goals.

Your next step: Use a platform like Stravito to tag, store, and search CI, so no valuable insight gets lost in emails or folders.

When CI becomes a shared habit, your organization can adapt faster, act on industry trends sooner, and maintain a clear competitive advantage.

Next, let’s look ahead at where competitive intelligence is headed in 2026 and beyond.

The future of competitive intelligence

We’ve looked at how CI in 2026 is about separating signals from noise. The next step is using those signals to shape the future, embedding intelligence into decisions across the business so strategy keeps pace with change.

AI and automation reshape workflows

Advances in AI knowledge management make it possible to tag, sort, and analyze competitive intelligence data automatically.

This helps competitive intelligence professionals spend less time on manual tasks and more time on strategic competitive intelligence activities like scenario planning, competitor analysis, and business development.

Real-time intelligence becomes standard

Quarterly reports are no longer enough. Leading organizations use real-time dashboards, competitive intelligence monitoring tools, and alerts to respond to:

- Industry trends as they emerge

- New competitor strategies spotted through online competitive intelligence

- Shifts in market factors that could impact pricing or positioning

CI expands across the business

Competitive intelligence in business is no longer just for a specialist team. It’s becoming part of daily workflows in product, marketing, sales, and operations.

This approach ensures business competitive intelligence is connected to your overall business strategy and supports every department.

A strong knowledge management framework is key here. It ensures that competitive intelligence research, market intelligence, and customer insights are centralized, easy to find, and aligned with business goals.

Final thoughts: Turning intelligence into action in 2026

Many of you already gather competitive intelligence. The opportunity now is to make it more impactful by turning data into intelligence that shapes strategy.

We’ve covered the types of CI, the process, and the tools that help you spot opportunities and guard against threats.

Your next step is to share those insights widely and embed them into daily decisions. The companies that win are those that act quickly enough to protect their advantage and respond with confidence to market changes.

Ready to turn your competitive intelligence strategy into a real growth engine? Request a Stravito demo and see how quickly your teams can activate insights and deliver results.

FAQs

What is competitive intelligence?

Competitive intelligence is the practice of gathering, analyzing, and sharing information about competitors, customers, and the market environment.

It involves competitive intelligence analysis to turn raw data into valuable insights that support your business strategy.

How is competitive intelligence different from market research?

Market research focuses on understanding customers, preferences, and demand.

Competitive intelligence takes a broader view, combining market intelligence, strategic intelligence, and competitor analysis to give you a complete picture of your competitive environment.

What are the benefits of a strong CI strategy?

A strong competitive intelligence strategy can:

- Reduce risk and surprises

- Identify growth opportunities

- Improve pricing and go-to-market strategies

- Strengthen your competitive advantage

- Give teams actionable insights to inform strategic decisions

What are the best sources for competitive intelligence?

Reliable sources include:

- Competitor websites

- Press releases

- Analyst reports

- Patents

- Customer reviews

- Social media

- Trade shows

- Internal sales data

Many teams also use competitive intelligence tools to speed up the data gathering process and improve analyzing data for better decision-making.

What are common mistakes to avoid in CI?

Common mistakes include:

- Focusing only on direct competitors

- Collecting too much data without synthesis

- Treating CI as a side project

Avoiding these ensures your competitive intelligence activities are tied to your overall business strategy.

How Stravito helps teams manage competitive intelligence effectively?

Stravito centralizes your competitive intelligence database, makes intelligence searchable, and supports faster competitive intelligence monitoring.

With AI-powered search, competitive intelligence professionals can quickly find, analyze, and share insights, enabling your teams to stay ahead of emerging market opportunities and potential competitive threats.